Taking out a loan can be a great way to get your finances in order and start building up your credit score. When you borrow money from a lender, you agree to repay that sum plus interest over a set period. This commitment shows lenders that you’re responsible and can be counted on to make payments on time. As long as you take out a loan for something that will help improve your financial situation – like consolidating debt or renovating your home – you’re likely to see benefits in the long run.

But before taking out any loans, there are a few things to keep in mind.

Look for reputable lenders

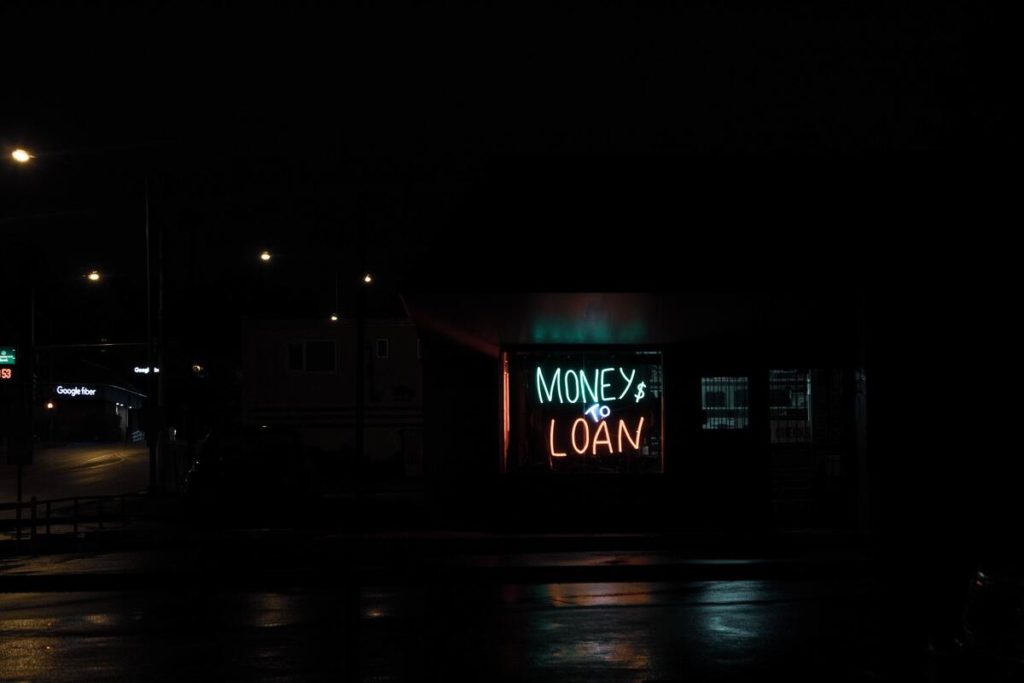

When you’re looking for a loan, it’s important to find a reputable lender. This means working with a company that has a good reputation and is known for providing fair and reasonable loans. Reputable lenders like USDA loans will also have a solid track record of helping borrowers repay their loans on time.

Working with a reputable lender is important because it can help protect you from predatory lending practices. Predatory lenders are companies that charge high-interest rates or fees, often trapping borrowers in a cycle of debt. So be sure to research any potential lenders before signing any contracts.

Know what your monthly repayments will be

When you’re taking out a loan, it’s important to know exactly what your monthly repayments will be. This way, you can plan and make sure you can afford the repayments comfortably.

Most lenders will provide a repayment schedule that outlines how much you’ll need to pay each month and for how long. Be sure to read this schedule carefully and ask any questions you have about it. If you’re not sure whether you can afford the monthly repayments, ask the lender for a loan estimate. This document will show you how much the loan will cost in total, including interest payments.

Check your credit score first

One of the most important things to do before taking out a loan is to check your credit score. Your credit score is a measure of how likely you are to repay a loan on time. Having a good credit score can help you get access to cheaper loans and enjoy lower interest rates.

If your credit score isn’t great, it might be harder for you to take out a loan with favorable terms. It could also cost you more in interest payments if you do manage to find a lender who’s willing to give you the loan. So before taking out any loans, check your credit score and make any corrections or improvements where possible. This way, you’ll increase your chances of getting affordable financing on good terms when you need it most.

Avoid predatory lending practices and look at the fine print

Don’t sign anything until reading through all the documentation and understanding exactly what it means for you. You should also make sure to avoid predatory lending practices, such as excessive fees and interest rates with hidden charges, or loans that target people who aren’t in a financial position to repay them.

It’s important to remember that lenders can’t just charge whatever they want for a loan. They’re required by federal law to abide by usury laws that limit the amount of interest and fees they can charge on commercial loans. So if your lender is charging you an usurious rate, report them immediately so you don’t get stuck with the bill.

Consider consolidating your debts

If you’re feeling overwhelmed by your debt, one option you might consider is consolidating your debts. Consolidating your debts means taking out a new loan to pay off all your old loans. This can be a great way to reduce your monthly payments and simplify your financial life.

But before you consolidate your debts, there are a few things to keep in mind. First, make sure you research all your options and compare interest rates from different lenders. Also, be sure to read the fine print before signing any contracts. And most importantly, make sure you can afford the monthly payments on the new loan.

If you’re considering consolidating your debts, contact a financial advisor for more information and guidance. They can help you find the best lender for your situation.

Conclusion

Borrowing money is a stressful decision, but it doesn’t have to be if you take the right steps. Just remember that there’s more than one way to borrow money and each person will have their own unique needs based on what they’re borrowing for. When all else fails, talk with your financial advisor about how loans might work for you before signing any contracts!